Analyzing Department Expense Variances How SL Can Help Control Expenses and Support Manager Accountability

Analyzing actual expenses to budget or forecast values is an important part of a well run company. Learn how SL can help control expenses.

Analyzing actual expenses to budget or forecast values is an important part of a well run company. Learn how SL can help control expenses.

Table of Content

A monthly departmental expense variance to budget or forecast meeting with accounting, is a useful tool used to proactively control expenses and support department manager accountability.

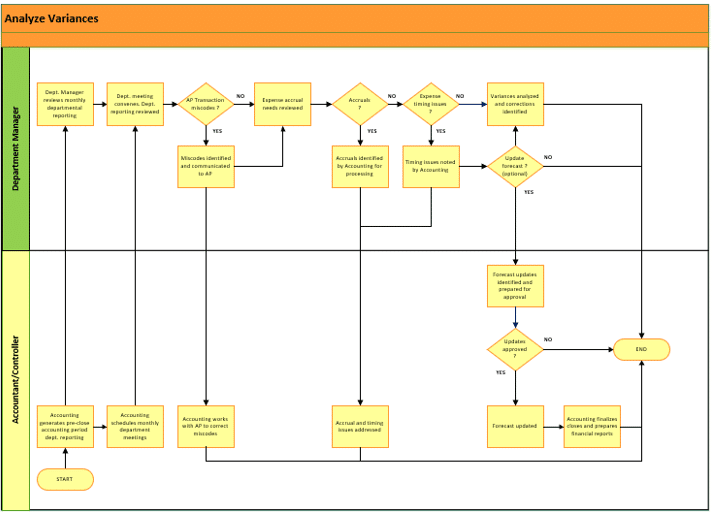

In a budget only setting, a review of department expense performance is scheduled as a part of the financial close. As a part of the closing process, preliminary departmental expense statements are distributed by accounting to department managers. The department manager reviews the reporting to identify issues and prepare for the accountant meeting. The meeting commences at some time during the period close.

In a forecast environment, the accountant reviews the balance of the forecast (from the current period forward to the accounting year end) with the department manager. Together, they identify any additional expense or expense reduction activity expected in future forecast periods.

SL plays a significant role in both scenarios by providing the user with several tools. Management Reporter functionality can easily handle any variance reporting needs. In addition to robust reporting, other SL functionalities such as multiple budgets and budget copy allow the user to build financial rolling forecasts which are incorporated into the monthly variance reporting when required.

To learn more about budgeting and forecasting, see Replacing Budgets with forecasts

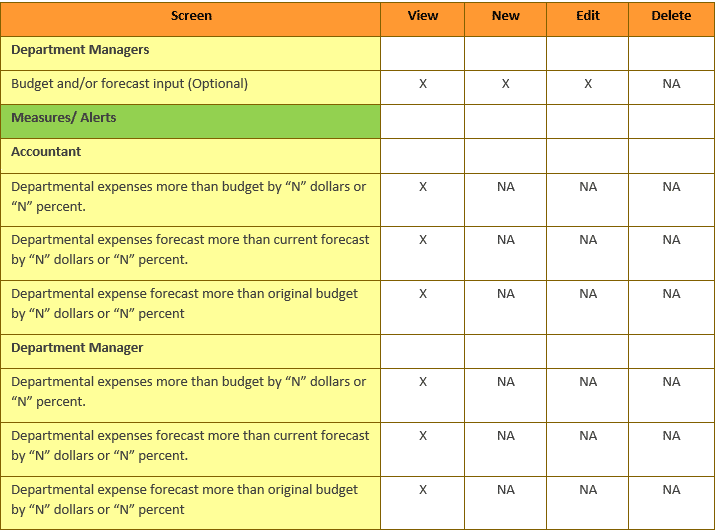

Measures and alerts are meant to assist the user in keeping abreast of processing status, identifying anomalies, and ensuring that implemented process controls are effectively employed. The information below illustrates the interaction between ERP functionality, measures and alerts.

Functionality- GL department expense statements (actual vs budget)

Measures and Alerts- Departmental expenses more than budget by “N” dollars or “N” percent.

In companies using a budget exclusively, department budget versus actual reporting is a major factor in departmental expense control. The report is produced by Accounting monthly, as a part of the period close. The report at this point is preliminary in nature and meant to provide the department manager with the information needed to prepare for the accountant meeting.

Using the departmental expenses more than budget by “N” dollars or “N” percent measure and alert allows accounting to quickly identify potential problem areas in advance and prepare for the departmental meeting.

In the meeting, actual department expenses are reviewed. Any AP, Payroll or GL journal entry issues are identified. Actual variances to the budget are discussed and noted by the accountant. The variance notes are reviewed during the final financial statement review and may be included in the financial statement package comments.

Additionally, the department manager identifies any expenses incurred, which have been invoiced but not yet vouchered and therefore not recorded in the General Ledger. The expenses are discussed with the accountant. An auto reversing GL journal entry accrual is prepared as needed.

The monthly closing process is usually very compact in terms of the time to complete. Many companies try to have the financial close completed and final reporting generated within 7 to 10 days after the period’s end date. With this short completion window, depending on the issue, a decision is made by accounting to accrue or correct transactions in the current period, or record them in the next period’s processing. Current period accruals or corrections are usually reserved for material transactions.

Functionality- Department expense forecasting

Measures and Alerts-

Departmental expenses forecast more than current forecast by “N” dollars or “N” percent.

Departmental expense forecast more than original budget by “N” dollars or “N” percent

In companies using a rolling forecast, the same process is completed as described above, except that expenses are compared to the current forecast instead of the budget.

Department expense future period forecasting can be a component of the monthly accountant meeting or scheduled separately. Since the current forecast period is not updated during the period close, and changes to the future forecast periods are processed after the current period close, the meeting is not required during the close process.

The forecast meeting reviews the current full year forecast’s remaining periods and includes a discussion and revision of the remaining monthly forecast values if required.

In the meeting, the department manager and accountant discuss any forecast variances in the applicable accounting period. In addition, any forecast revisions to future periods are discussed. The accountant notes the revisions and reviews them with the applicable company executives.

If approved, the forecast revisions are processed. Forecast revisions are entered by accounting using the applicable budget version. SL multiple budget functionality streamlines the process considerably and eliminates the need of using spreadsheets to track forecast values. Use the same forecast version the entire year or use SL budget copy functionality to make a new budget version for each forecast.

If the forecast changes are not approved, the accountant informs the department manager that the forecast revisions will not be processed. The department manager and the accountant then work together to prepare action plans to work-around the non-approved forecast revisions.

Note that forecast-related SL measures and alerts are generated and available after the current accounting period has been closed, and the remaining months re-forecast, allowing the department manager to review the full year results of the revised forecast. The forecast measures and alerts above quickly identify potential problem areas in advance and communicate the issues to the department manager and accounting.

Some companies may analyze actual results to both the original budget and the forecast. While seemingly redundant, there may be value here, as material changes between the original budget and the current forecast may have occurred, and knowing how the original budget was prepared, can provide additional insight. SL Management reporter can be used to build reports to assist in this analysis. Since the forecast is merely a different budget, both the original budget and the forecast can be included in the required reporting.

This analysis is optional and should be used only if current staffing levels can support the additional workload. Remember, a budget is usually a static estimate which isn’t revised during the year. The forecast on the other hand is updated monthly, and in my opinion, is a much more accurate performance measure of both revenue, cost of sales and expenses.

Successfully implementing a new process isn’t always easy. Consider the best practices below to streamline and control new process implementations.

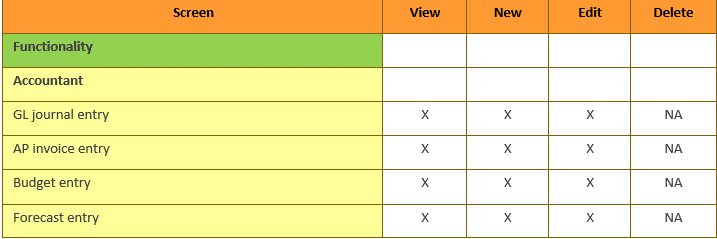

System permissions and security functionality play a key role in any ERP process. Using these “feature rich” ERP tools, allow the user to set up efficient and controlled processes.

A common variance analysis process permissions example is displayed in the table below:

Analyzing actual expenses to budget or forecast values is an important part of a well-run company. At this point, you may or may not have decided if a budget or rolling forecast analysis is the way to go. No matter which method you choose, a monthly expense variance review is a valuable tool used to proactively control expenses and support department manager accountability.

A successful variance analysis process needs to:

Use SL Report Manager functions to create and distribute the reporting required to support the process. Use other SL tools such as multiple budgets, reversing JE’s, measures and alerts to control and streamline monthly variance reporting and review.

Stay within your company’s capabilities and be sure to get the most value from your level of effort.

Talk to us about how Velosio can help you realize business value faster with end-to-end solutions and cloud services.