Understanding Cost Accounting in Cannabis Inventory Management

Learn the important role of cost accounting in cannabis inventory management. Plus discover some common methods and when and how to use them.

Table of Content

It doesn’t matter if you’re a distributor, retailer, or cultivator — in the cannabis industry, inventory is everything.

Effective cannabis inventory management and costing are key when it comes to:

But it’s not exactly easy or straightforward. Cost accounting is challenging enough without the added complexity that comes with operating in the cannabis space.

And with that in mind, we’re going to look at the critical role of cost accounting in the cannabis space. We’ll then take a look at some common inventory costing methods — and explain when and how to use them on the job.

Cost accounting (or inventory costing) describes the process of documenting, analyzing, and categorizing all costs associated

with producing a finished product or delivering a service.

Regardless of industry, inventory costing is a challenging process that requires companies to record and analyze all costs — fixed and variable, direct and indirect — and use that information to optimize processes and make decisions about the future of the company.

Done right, cost accounting enables decision-makers to accurately forecast future cash flows, profit margins, and the profitability of individual products.

Cost accounting represents a complex accounting and tax challenge for cannabis operators for a few key reasons.

For starters, there aren’t any veteran cannabis accounting experts to provide guidance when it comes to calculating accurate inventory valuations — or even offer reliable advice for how to file their tax returns. While the industry is maturing, we still have a long way to go before hiring someone with 15, 20+ years of specialized cannabis accounting experience is even an option.

All cannabis companies are required to follow Generally Accepted Accounting Principles (GAAP) to take advantage of tax deductions. At the same time, section 280E of the IRS Tax Code significantly limits the amount of tax deductions cannabis companies can write-off when they file their returns.

Additionally, inventory costing must be fully documented and auditable according to IRS/GAAP requirements. But, some of the unique characteristics of the cannabis space make it difficult to meet those requirements.

For example, the high-volume of cash-based transactions, limited access to traditional banking, inventory tracking, etc. — all make it much harder to maintain complete, accurate financial records.

There are three main inventory costing methods cannabis companies can use to determine how much their inventory is worth, as well as manage and control their finances. Here’s a quick look at each of those options:

The first in, first out method, also known as FIFO, assumes that whatever goods you purchased first will be sold first (essentially, you’re rotating stock).

You can calculate your cost of goods sold (COGS) with the FIFO method using this simple formula:

FIFO = Assigned cost of your oldest inventory per unit x number of units sold

Here’s a really basic breakdown of how FIFO is used to determine the value of your inventory:

This approach is typically used by businesses that deal with perishable inventory – like restaurants, grocery stores, and companies that manufacture and distribute perishable goods – as well as companies that experience short demand cycles.

Within the cannabis space, FIFO is ideal for companies that produce and/or sell things like edibles, cannabis-infused beverages, or tinctures with a limited shelf life.

And – even for those that focus on longer lasting products, FIFO ensures that customers receive the freshest products (key when it comes to building long term loyalty) and it helps companies avoid losses linked to old, unused inventory. In most states, cannabis companies are required to destroy unsold items after a certain amount of time.

Additionally, by selling older, cheaper stock first, while higher-priced items stay on the shelves, companies are able to report lower COGS, while at the same time, bringing in a higher net income.

That said, FIFO isn’t perfect. Higher net incomes mean higher taxes and the discrepancy between incoming revenue and the assigned inventory costs of older products can lead to confusion without the right tools in place.

Last in, last out – or LIFO is, you guessed it, the opposite of FIFO. Here, you’re assuming that the newest items will sell first. So, in this case, you’ll tweak the formula to reflect the cost of the freshest stock:

LIFO = Assigned cost of newest inventory per unit x number of units sold

Now, let’s use the example from above to illustrate the difference between LIFO and FIFO.

LIFO works best for businesses that operate in industries where the inventory prices are volatile – and costs increase relatively often.

The idea is, this allows you to avoid losses and sell products for a profit. You’ll pay lower taxes than you would using FIFO – but only because you’ll end up with fewer profits – and by extension, a lower taxable income.

Obviously, LIFO only works for non-perishable items. We’re talking things like building materials, furniture, or housewares with no upper limit when it comes to shelf life),

And as such, it may not be the best method for cannabis inventory management. Per Leafwell, cannabis flowers, wax, and hash can last up to 18 months under the right conditions, while CBD tinctures and vapes are good for about two years.

But certificates of analysis from most third-party testing labs expire within six months of testing. Meaning, you’ll have to retest products if they hang around too long. Plus, you’ll want to make sure that you’re not selling products on the brink of expiration. That way, customers have time to enjoy them at their peak.

The weighted average cost inventory method – aka WAC – splits the difference between LIFO and FIFO and instead, calculates the average cost of their inventory – regardless of age.

You can use the following formula to get your WAC calculation:

WAC = (Total cost of your current inventory) / (number of units sold)

The main benefit of the WAC method is it’s one of the fastest and easiest ways to calculate the value of your cannabis inventory. And for the most part, it’s accurate enough to help cannabis companies control their finances – even in the face of fluctuating costs, testing delays, and other challenges.

It works best for companies with little variation between products, high transaction volumes, or frequently purchase goods subject to price volatility.

The downside is, the IRS only allows you to use FIFO, LIFO, or specific identification for reporting, auditing, and tax deductions. After all, a “good enough” system isn’t good enough for the detail-obsessed tax agency.

This means that WAC devotees will still need to use one or more approved methods when conducting “official” business with the IRS or other regulatory agencies.

While two out of three “traditional” costing methods can help you stay in the IRS’ good graces, they aren’t so great when it comes to guiding certain types of day-to-day decisions that impact the bottom line – like, how much does it cost to grow each plant? Or produce a pound of cannabis, hemp, or CBD? What does it cost to manufacture a specific product or product line?

For example, cultivators calculate inventory costs using the agricultural method, processors follow manufacturing accounting best practices, and dispensaries track inventory using a retail accounting process.

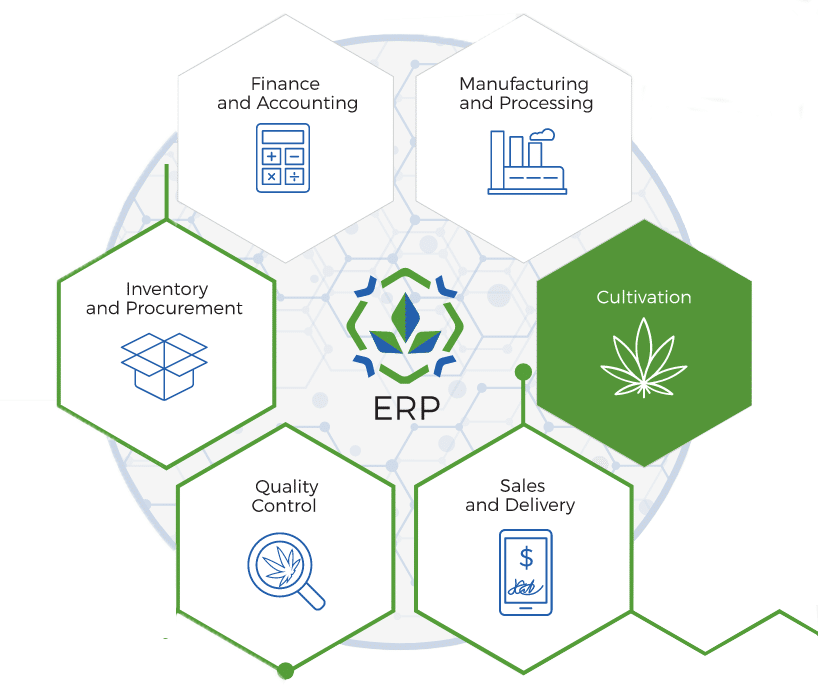

In this case, it’s important that all data is unified and stored in one system – that way, you can track and manage costs associated with cultivation practices, agricultural conditions, and manufacturing processes against IRS-approved methods like LIFO and FIFO.

Proper cost accounting is a critical competency for cannabis companies.

They need cannabis inventory management solutions that eliminate waste, boost profits, and improve cash flow.

Maintaining accurate, highly-detailed records helps you hang on to your license, as well as secure investor funding and other resources you need to grow. It also has significant implications for tax compliance. In order to properly file 280E expenses on your tax return, you’ll need to understand the nuances of cost accounting, GAAP, and other practices that come with operating in a tightly regulated space.

Keep in mind, GAAP isn’t typically required for SMBs – and as such, complying with standards demands a specific skill set beyond what’s required from your average small business accountant.

Because most states require cannabis operators to use an approved seed-to-sale solution and document all financial transactions for auditing and reporting purposes, the idea of seeking out an integrated ERP may not seem like a natural choice.

Instead, newcomers may end up opting for seed-to-sale software, plus an entry-level accounting system like Quickbooks to fill any finance-specific gaps. Worse, some companies may even fall back on manual workarounds – like spreadsheets – to manage inventory, expenses, and cash-based transactions.

With SilverLeaf built on Microsoft Dynamics 365 Business Central, you can manage everything—from cost accounting to track-and-trace compliance and sales— in one central hub. Users can instantly calculate the value of their inventory using any or all of the above methods. And, use data from each of those calculations to inform critical decisions.

And better yet, baked-in intelligence and automated controls ensure accuracy and compliance – with GAAP, the IRS, and state regulators with minimal effort.

Whether you manage cannabis inventory with FIFO, LIFO, or WAC, you’ll need the right set of tools to make it happen. And it all starts with a reliable, flexible solution like SilverLeaf built on Dynamics 365 BC.

Velosio is a certified Microsoft partner with 30+ years of hands-on experience implementing industry-specific solutions. Our cannabis industry experts can help you get started.

Want to learn more? Check out SilverLeaf for cannabis growers.

#1 What is cost accounting for the cannabis industry?

Cost accounting for cannabis inventory management involves documenting, analyzing, and categorizing all costs associated with producing a finished product. With the right solution – like SilverLeaf + Dynamics 365 BC – and processes in place, cannabis companies can optimize their operations, maintain compliance with state and federal regulations, and make better informed financial decisions.

#2 What does COGS stand for?

COGS stands for Cost of Goods Sold. It represents the direct costs attributable to the production of the goods sold by a company. In the cannabis industry, calculating COGS accurately is very important for tax reporting and financial analysis.

#3 What are COGS for cannabis companies?

For cannabis companies, COGS includes all the direct costs involved in producing cannabis products. This can encompass expenses related to cultivation, such as seeds, nutrients, and labor, as well as processing costs for turning raw cannabis into products like edibles, tinctures, or concentrates. Accurately calculating COGS is essential for compliance with the IRS and state regulations, particularly under section 280E of the IRS Tax Code, which limits the tax deductions cannabis companies can claim.

{

“@context”: “https://schema.org”,

“@type”: “FAQPage”,

“mainEntity”: [

{

“@type”: “Question”,

“name”: “What is cost accounting for the cannabis industry?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “Cost accounting for cannabis inventory management involves documenting, analyzing, and categorizing all costs associated with producing a finished product. With the right solution – like SilverLeaf + Dynamics 365 BC – and processes in place, cannabis companies can optimize their operations, maintain compliance with state and federal regulations, and make better informed financial decisions.”

}

},

{

“@type”: “Question”,

“name”: “What does COGS stand for?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “COGS stands for Cost of Goods Sold. It represents the direct costs attributable to the production of the goods sold by a company. In the cannabis industry, calculating COGS accurately is very important for tax reporting and financial analysis.”

}

},

{

“@type”: “Question”,

“name”: “What are COGS for cannabis companies?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “For cannabis companies, COGS includes all the direct costs involved in producing cannabis products. This can encompass expenses related to cultivation, such as seeds, nutrients, and labor, as well as processing costs for turning raw cannabis into products like edibles, tinctures, or concentrates. Accurately calculating COGS is essential for compliance with the IRS and state regulations, particularly under section 280E of the IRS Tax Code, which limits the tax deductions cannabis companies can claim.”

}

}

]

}

Talk to us about how Velosio can help you realize business value faster with end-to-end solutions and cloud services.